Content

Content

- Home

- Context

-

Management Report

- The Operating Environment...and Trends Refining Our Portfolio...and Reinventing Our Future Financial Value Creation Delivering Value to Customers...and their Value to Us Working at Dimo...Enjoyable and Rewarding Our Business Partners...A Symbiotic Relationship Regulatory Authorities...Playing by the Rules Our Community...Live and Let Live The Environment...Now and for Generations Yet Unborn Sustainability Performance Objectives in 2012/13

- Stewardship

-

Financial Reports

- Annual Report of the Board of Directors Statement of Directors' Responsibilities for the Financial Statements Independent Auditors' Report Income Statement and Statement of Comprehensive Income Statement of Financial Position Statement of Changes in Equity Cash Flow Statement Notes to the Financial Statements

- Appendices

- Downloads

The Annual Report Company

The Operating Environment...and Trends

In formulating this commentary we drew on material from several external sources.

Global Economic Environment

A noticeable slowdown in the emerging market and developing economies characterised 2012. GDP growth in these economies which stood at 4% in 2011 slowed to 3.2% in 2012. Key influential factors were a sharp deceleration in demand from key advanced economies as well as tightening of domestic policy and the end of investment booms in some of the major emerging market economies.

Growth in emerging market and developing economies is expected to reach 5.3% in 2013 (2012-5.1%) and 5.7% in 2014.

Global prospects have improved again but the road to recovery in the advanced economies will remain bumpy. World output growth is forecast to reach 3¼% in 2013 and 4% in 2014. From a macro view point, emerging markets and developing economies will continue to remain relatively strong, whilst of the advanced economies, the US is expected to do better than countries in the Eurozone.

Global Automotive Industry

Auto sales growth in China, the world's biggest car market, fell short of expectations last year, as the economy slowed and cities put limits on vehicle numbers. Sales rose 4.3% year-on-year in 2012 to 19.31 million vehicles, well below forecasts of 8%.

In the USA, the the auto industry experienced a welcome recovery, with sales increasing by 13% over 2011,

Japanese manufacturers too had a good year with sales up by 20% over the previous year and in the process, shaking off the doldrums of post tsunami inventory shortages that prevailed last year.

Volkswagen led all major automakers with sales up by 35%. A key driver of this growth was the success VW achieved with its redesigned Passat midsize Sedan. VW sold more than five times as many Passats last year as it did in 2011.

The automobile industry remains a growth sector worldwide, despite the economic crisis in the Southern European countries, as well as the loss of interest in cars among many Europeans, for whom a motor vehicle is no longer a status symbol but a means of transport that can also be rented on an as-needed basis. Demand is growing in China, India, Russia, Brazil and many other markets outside Europe. About 70 million vehicles were sold worldwide last year, and sales are expected to increase to 90 mn by 2020.

Despite a revival in the US and strong sales in China, the global automobile industry is not expected to repeat its success, with projected sales for 2013 set to reach less than half the level achieved in 2012. According to various estimates, the global auto industry is likely to record a growth of just over 2% in 2013, compared to a growth of 5% in 2012. Europe and many of the BRIC markets including India continue to struggle and the prognosis for the industry for 2013 doesn’t indicate much momentum.

The Sri Lankan Economy

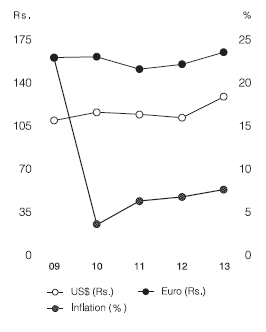

The economy grew by a modest 6.4% in 2012. Inflation was maintained in ‘single digit territory’ for the fourth consecutive year despite several global and domestic areas of challenge.

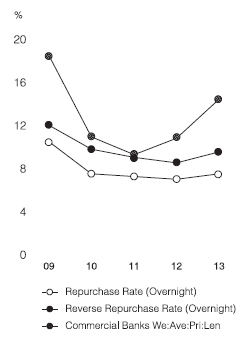

The relative ‘boom’ we saw in 2010 and 2011, with GDP growth reaching and exceeding 8%, largely evaporated in the year under review. High credit and monetary expansion and a widening trade deficit fuelled by high import demand led the Central Bank to adopt a comprehensive policy package in early 2012, involving monetary, exchange rate and fiscal elements as well as adjustments to administratively determined prices. This ushered in a regime of raised policy interest rates and a ceiling being imposed on rupee lending by licensed banks to moderate credit growth.

The Transportation Sector

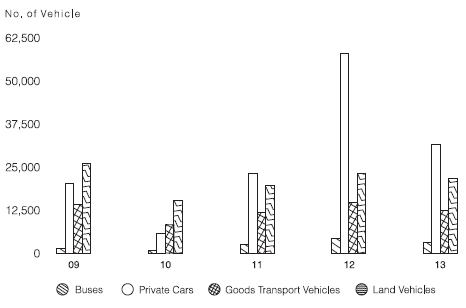

The impact of changes to the Government’s Tariff/Fiscal policies towards vehicle imports, from those prevailing in the previous reporting period, is clearly evident in the table appearing hereunder. The sale and registration of vehicles for 2012 significantly reduced in comparison with 2011. As over 75% of the Group’s business revolves around the vehicle segment, this information needs to be ‘digested’ and addressed.

| YEAR | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 |

| Class of vehicles | ||||||

| Motor cars | 31,546 | 57,886 | 23,072 | 5,762 | 20,237 | 22,603 |

| Three-wheelers | 98,815 | 138,426 | 85,648 | 37,364 | 44,804 | 43,068 |

| Motor cycles | 192,284 | 253,331 | 204,811 | 135,421 | 155,952 | 182,508 |

| Buses | 3,095 | 4,248 | 2,491 | 739 | 1,180 | 2,637 |

| Dual purpose vehicles | 37,397 | 33,518 | 11,712 | 1,280 | 2,856 | 5,193 |

| Goods transport vehicles | 12,266 | 14,818 | 11,845 | 8,225 | 14,038 | 18,408 |

| Land vehicle | 21,892 | 23,194 | 19,664 | 15,284 | 26,132 | 23,475 |

| TOTAL | 397,295 | 525,421 | 359,243 | 204,075 | 265,199 | 297,892 |

Source: Department of Motor Traffic

To expand on the data presented in the table above, registration of new motor vehicles decreased substantially (24%) during 2012 owing to higher import duties imposed on vehicle importation. In comparison, in 2011 an increase in registrations of 46%was recorded over 2010. The decline occurred primarily due to the increase of excise taxes on motor vehicles. The number of cars registered decreased by 46%during 2012 while registration of buses and three wheelers declined by 27% and 29%, respectively. However, registration of land vehicles such as tractors declined only marginally (6%) due to the improvement in the agricultural and industrial sectors.

The considerable momentum witnessed in 2011 as regards development within the sector, most particularly in road and transport infrastructure development continued into the current reporting period as well.

Agriculture and Fishing

With extensive business interests in earth moving equipment, agricultural machinery, industrial refrigeration equipment and marine solutions, the performance of the Agriculture and Fishing sector of Sri Lanka is of significant interest to Dimo.

The agriculture sector grew by 5.8% in 2012, amidst drought conditions in the third quarter of the year and heavy monsoonal rains and floods in the latter part of the year, recovering from a slow growth of 1.4%in 2011. All subsectors, except for tea, rubber and minor export crops contributed positively towards this growth. The favourable weather conditions that prevailed in the early part of the year produced a bountiful paddy harvest in the Maha season; consequently, the agriculture sector contributed 11.1% of the total GDP in 2012, compared to 11.2% in 2011.

Total national fish production in 2012 increased by 9.3% to 486,170 metric tons driven by substantial increases in coastal marine fishery and inland fishery.

Industry and Services

Dimo has a healthy interest in the performance of the industry and service sectors as it has significant business inputs in areas such as the sale of machinery for road construction, retailing of forklifts, material handling machinery, racking systems, power tools and accessories, lamps, lighting units and related accessories thereof.

The industry sector, which accounts for approximately 30.4% of GDP, grew by 10.3% in 2012, contributing substantially to the expansion of the economy.

Sustaining the high growth momentum recorded during the past year, the construction subsector recorded an impressive growth of 21.6% compared to 14.2% in 2011. This is the highest growth registered by the subsector in the past ten years. The subsector contributed 8.1% to the overall GDP and 23.9% of the change in GDP growth from 2011 to 2012 becoming the growth driving subsector in the industry sector.

Growth in the services sector, which is the largest sector of the economy, accounting for 58.5% of GDP moderated to 4.6% in 2012 from 8.6% in 2011.

Economic and Social Infrastructure

This is another sector of relevance to the Dimo Group, given the enterprise it conducts in terms of retailing of medical equipment, pumps, building technologies and power engineering solutions.

Power

Electricity generation in 2012 increased moderately by 2.4% or 11,800 GWh compared to 11,528 GWh in 2011. Severe drought conditions that prevailed during the period June to October 2012 caused a decline in the contribution of hydro power to the country’s total power generation. The share of power generated by CEB, in relation to total power generation decreased to 52% in 2012 from 57% in 2011, reflecting the increase in the share of power produced by the private sector from 43% to 48%. The Jaffna peninsula was connected to the national grid in September 2012 after a period of 25 years.

The addition of these new power plants to the national grid will help increase the total installed capacity of the country by around 37% to 4,532 MW by end 2017.

Water Supply and Irrigation

The demand for pipe borne water has increased significantly in line with rapid expansion in commercial and industrial activities and urbanisation. The National Water Supply & Drainage Board provided 137,874 new water connections in 2012. The total number of connections managed by them reached 1.6 million, reflecting a 9.5% increase.

Health

The present demographic dividend with a larger working age population is challenged by emerging health related issues. The high proportion of working age population with a lower dependency ratio due to the fall in fertility rate below replacement level provides a demographic dividend at present. However, this period will be followed by a gradual decline in the share of working age population and an increasing dependency ratio, due to the aging of the population. Considering this rise in the dependent population, keeping vulnerability levels in check will be increasingly challenging with limited resources.

In recent times, there has been a surge in NCDs, such as cardiovascular disorders, diabetes, kidney disease, cancer and mental illness. While NCDs have beaten communicable diseases as the leading cause of death in the country, the trend is expected to continue in the context of an increasingly aging population.

It is expected that the growing per capita income will entail significant changes to lifestyles, adding major risk factors for developing chronic NCDs. Such factors include unhealthy dietary habits, job stress and tension, physical inactivity, smoking and harmful alcohol use.

Economic Outlook and Implications

Sri Lanka has set its sights on developing into a US dollar 100 bn economy by 2016. The achievement of this goal would demand the improvement of all public utilities to a level that could cater to a modern economy effectively and efficiently. The current capacities and capabilities of public utilities such as electricity, water supply, sewerage and solid waste disposal as well as transportation need to be significantly improved to facilitate a growing economy.

Sri Lanka’s labour market needs to be reoriented to face the challenges of achieving sustainable high economic growth. The unemployment rate, which has remained below 5% since 2010, reached a historic low of 4% in 2012. Although such low rates of unemployment could give rise to wage pressures, low labour force participation rates and possible underemployment in some sectors indicate that there is still room for the supply of labour to improve. The agriculture sector employs about 31% of the labour force, while generating only 11% of the country’s GDP. This shows the extent of underemployment in this sector and the vulnerability of a large share of population and their relatively low incomes to supply disruptions caused by adverse weather conditions.

The challenge of an ageing population caused by the slow population growth needs to be addressed with a long-term focus through strengthening retirement benefit schemes and reforming the health sector.

Sri Lanka’s achievements in reducing absolute poverty, even while facing an internal conflict, are well-documented, but focused policies to eradicate poverty and reduce income inequality need to continue. Income inequality, as measured by the Gini coefficient, has remained high at 0.49 during the 2006/07 and 2009/10 Household Income and Expenditure Surveys (HIES).

It is essential to strengthen the framework for sustained economic growth based on the strategy of 5 hubs (aviation hub, maritime hub, energy hub, commercial hub and knowledge hub) plus tourism to diversify the economy and improve the resilience of the economy to external and internal shocks

The implementation of required structural adjustments including tax reforms and exchange control liberalisation, strengthening of institutions, and the continuation of the fiscal consolidation process are essential for Sri Lanka to sustain this high growth momentum.