Content

Content

- Home

- Context

-

Management Report

- The Operating Environment...and Trends Refining Our Portfolio...and Reinventing Our Future Financial Value Creation Delivering Value to Customers...and their Value to Us Working at Dimo...Enjoyable and Rewarding Our Business Partners...A Symbiotic Relationship Regulatory Authorities...Playing by the Rules Our Community...Live and Let Live The Environment...Now and for Generations Yet Unborn Sustainability Performance Objectives in 2012/13

- Stewardship

-

Financial Reports

- Annual Report of the Board of Directors Statement of Directors' Responsibilities for the Financial Statements Independent Auditors' Report Income Statement and Statement of Comprehensive Income Statement of Financial Position Statement of Changes in Equity Cash Flow Statement Notes to the Financial Statements

- Appendices

- Downloads

The Annual Report Company

This is Dimo

Diesel & Motor Engineering PLC, better known as Dimo is a public quoted company listed on the Colombo Bourse. Founded in 1939, Dimo operates across the five business segments, representing several best-in-class Principals. Headquartered in the commercial capital of Colombo in Sri Lanka, Dimo has an extensive network of sales and after-sales facilities spread throughout the Island and a team of over 1500 employees.

Our vision is to be the leader in all the businesses we are engaged in, by building a world-class team and partnering with the best in the world, to deliver, lasting and outstanding value to all our stakeholders.

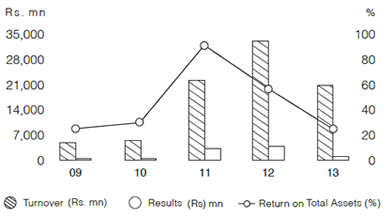

Vehicle - Sales

Passenger cars, SUVs, and a range of commercial vehicles from small 750kg trucks to large 40 Ton+ trucks to tippers, buses, tractors, agri-implements and harvesters.

Principals Represented

![]()

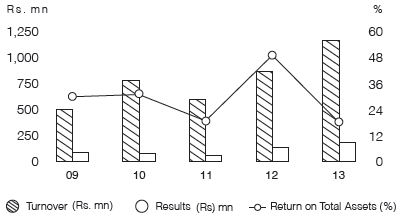

Performance Highlights of the Year

Both Turnover and the number of units sold decreased by 37%. Total industry volumes of commercial vehicles decreased by l8% and, tractors and harvesters by 40% and 60% respectively. Mercedes-Benz passenger cars were the most severely affected. Chrysler and TATA passenger cars and Jeep also performed below expectations. The silver lining is that we increased our market share in several categories of the light commercial category such as the LCV bus, trucks and tippers segments.

Outlook for 2013/14

The end to the ceiling on credit growth imposed on banks, a downward trend in interest rates and a stable exchange rate should translate to a gradual increase in demand for commercial vehicles. Passenger cars would however remain challenged with the prevailing high tariffs. The forthcoming launches of the two new Mercedes-Benz models; the A-Class and the S-Class Hybrid together with our launch of Sri Lanka’s largest range of tractors in Q4 would provide a fillip. Overall, we remain cautiously optimistic.

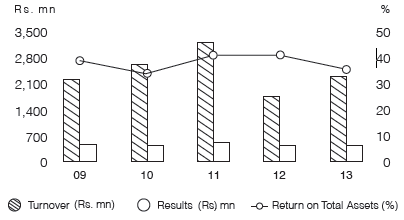

Vehicles – After Care Services

Parts for the after-care markets of passenger vehicles, commercial vehicles and agri-machinery plus engine management systems and services.

Principals Represented

Performance Highlights of the Year

Long-term investments on aftercare including de-centralization and opening of new workshops island wide have already begun to show results. Last year’s growth momentum was maintained. Turnover across most segments increased with TATA parts recording nearly a 20% rise. Vehicle throughput for TATA commercial vehicles increased from last year’s record 45,281 units to 53,480 units, as was the service hours sold increasing from 208,767 to 244,691. The Bosch diesel and car service centre grew turnover by 73%.

Outlook for 2013/14

We expect the growth not just to continue but also to pick up momentum as our new investments come on stream. The Mercedes-Benz Centre, which would be completed by the end of 2013, will provide an integrated sales, service & parts solution under one roof. With technical specifications and green guidelines from Daimler AG, the new centre will usher a new paradigm in vehicles sales and after care in the Country.

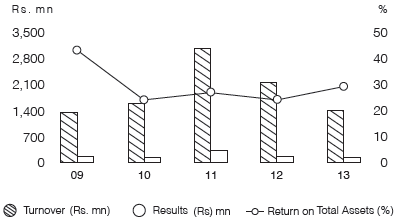

Marketing and Distribution

Hitherto known as Lighting and Power Tools the scope of this segment has been widened with some activities previously under Vehicles and After Care Service; Range of lamps, lighting fittings, Industrial & domestic power tools, tyres, and original equipment manufacturers (OEM) parts.

Principals Represented

Performance Highlights of the Year

Turnover from Lighting Products, OEM parts, commercial vehicle tyres and passenger vehicle tyres increased by 3%, 7%, 26% and 33% respectively. The new Kumho brand of tyres launched last year played a major part. In contrast. Turnover from power tools and Bosch auto components reduced by 3% and 16% respectively. Despite the drop in turnover, our power tools remained the market leader with a 38% share of the branded powertools market.

Outlook for 2013/14

Developments in the construction sector and the emerging trends in adopting smart technology for lighting would fuel growth in power tools and lighting products, respectively. Further streamlining of supplies of passenger car tyres and positioning Kumho as a preferred brand would ensure growth momentum in tyre sales.

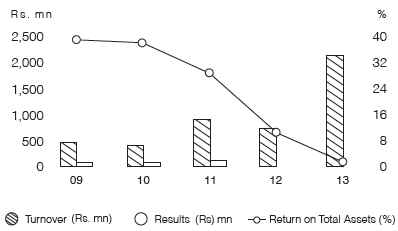

Construction & Material Handling Equipment and after services

Construction and mining equipment, compaction, and road building machinery, concrete machinery, fluid management systems, forklifts, storage and racking systems, building cleaning and maintenance systems, aerial work platforms, parking systems and construction machinery parts.

Principals Represented

Performance Highlights of the Year

Machinery equipment sales were severely challenged by an influx of cheaper alternatives from China. Thus, turnover from this line dropped by 42%. Nevertheless, turnover from the sale of construction machinery parts increased by 12%. A range of warehousing systems, automated racking systems & cold storage systems were sold to several clients.

Outlook for 2013/14

Growth potential remains high with the infrastructure development projects and plans under way and growth in the construction sector.

Electro-Mechanical, Bio Medical Engineering and Marine

Power solutions, building automation systems, fire

detection protection and suppression systems,

CCTV and access control systems, public address

systems, power systems for marine propulsion and

rail traction, industrial refrigeration and medical

equipment .

Principals Represented

Performance Highlights of the Year

Landmark projects were once again won or completed. They included the a complex fire detection system, fire pump and water supply systems & sewerage pump systems at Mattala International Airport, an Access Control System at the Central Bank of Sri Lanka, the country’s first Nero Biplane Angiography System to Central Hospital, the electrical installations one of the Country’s largest grid sub station projects.

Outlook for 2013/14

Large scale infrastructure development projects, growth in the hotels sector and hospitals sector augur well for the prospects.